Is decline in multi-unit restaurant locations a “bleeding” indicator?

Contraction. Most consider it a four-letter word when talking about restaurant growth. And they wouldn’t be wrong. Yes, contraction among multi-unit restaurants means location count is shrinking—but it’s not always a reason to write off a brand as a prospect or to hit the panic button.

It is a reason to double down on tracking, monitoring, and activating multi-unit location count data and territory insights to:

- Diversify markets or segments in your GTM strategy

- Pivot sales tactics

- Stay in lock-step with closures across territories or within target accounts

In our second installment on how to read the multi-unit restaurant market and understand its growth, we’re taking a closer look at contraction. What it is, what it isn’t, and how advances in restaurant location count data are equipping GTM, sales, and marketing teams with strategically actionable territory, segment, and account-based insights.

If you haven’t read the first blog in our three-part series on interpreting restaurant growth, we recommend you read it before you dive in here so that you better understand the way we interpret multi-unit restaurant life-cycle statuses and growth using Restaurantology’s market intelligence and insights. If you’re up-to-speed or are here for restaurant location contraction insights only—keep scrolling.

Read first: Is restaurant unit growth the best measurement of success? →

What is contraction?

Contraction is an official stage found within the broader economic life cycle. There are four stages in an economic life cycle:

- Expansion (Growth)

- Peak

- Contraction (Recession)

- Trough

A contraction is a correction after a period of expansion and a peak. It occurs in a particular market or industry. In our case, we’re zooming in on—you guessed it—restaurants.

What are the characteristics of contraction?

In general economic terms, contraction is characterized by a decline in economic activity that spreads over at least a few months. You’ll see growth slowing, employment falling, and prices stagnating during the correction phase.

Let’s translate that statement.

If you’ve been selling into (or following) the restaurant industry closely in your sales or marketing careers, chances are you know the tell-tale signs of a restaurant contraction at a macro level. Just digging your heels in? No worries. Here is the confluence of conditions that lead to a contraction in the restaurant industry:

- Staffing shortages

- Reduction in consumer spending

- Increase in the cost of goods

- Increase in rent and commercial real estate prices

- Tightening of available credit

- Interest rate hikes

- Weakening investment sentiment

- Increase in M&A activity

Contraction hits different in the restaurant industry

If you only read the information above, it’d be easy to think that a contraction happens to the entire restaurant industry in one fell swoop. There’s undoubtedly a halo-like effect—but it’s not that simple.

For our conversation here, the most notable and simplest byproduct of contraction in the restaurant industry is a decline in location count.

Restaurant brands shutter the doors of underperforming stores. They abandon a competitive-rich region when share of wallet only goes so far. Some segments sink, while others soar—for a while, at least.

And therein lies one of the most significant headwinds for sales and marketing teams. We can all agree it would be fantastic if every single factor that goes into a multi-unit restaurant brand’s performance was accessible and could be analyzed to be proactive. We want answers to questions like:

- Which segments will get hit hardest?

- Which brands are braced for impact?

- Which brands are at risk of bankruptcy?

While those are great questions to ask, they’re too big-picture, and there’s far too much guesswork for fast-acting go-to-market teams. When revenue, sales, and marketing targets are on the line, “big picture” and “guesswork” are not words leadership wants to hear.

This brings us back to location count. At Restaurantology, we believe “location” or “unit” count is the best way to assess a multi-unit restaurant brand’s growth or contraction. Why, you ask? For one, it’s the best and most accurate data available at scale via public websites.

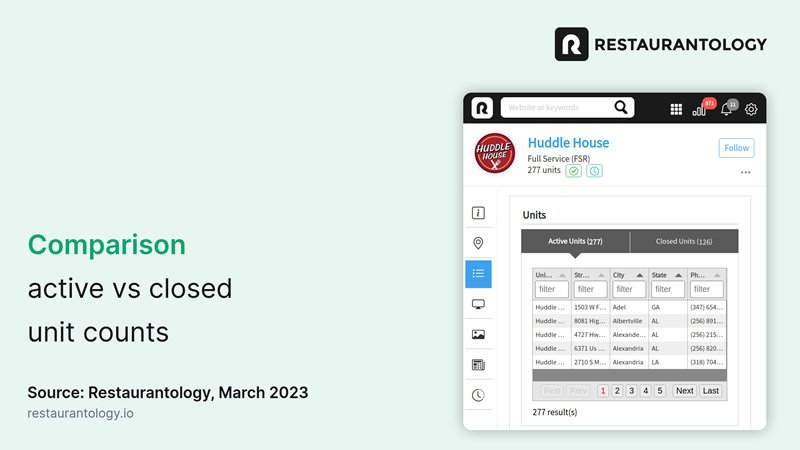

Each month, Restaurantology looks across 15,000+ websites to verify unit trend data and provides qualified restaurant market intelligence to our partners. With that verified information on unit count and historical closures neatly organized by parent company, concept, and individual units—teams can now quickly activate that data at scale to understand contraction at any given time for one or many different restaurant brands, segments, or cuisine.

While we track new openings to get an accurate location count (which we verify directly on each multi-unit concept’s website), we also keep an eye on publicly available store-level historical closures. We consider a unit or location a historical closure if it has been permanently closed within twenty-four (24) months.

Activating Historical Closure insights

So, why is this data essential, and what can sales and marketing teams do with this information?

Assessing historical closures can help infer brand strength and stability, market positioning, risk factors, and more. Having accurate and up-to-date historical closure data is a powerful insight to adapt territories and generate a targeted list of qualified prospects. Let’s look at the location and historical closure insight tools available in Restaurantology.

Restaurantology’s Closure filter

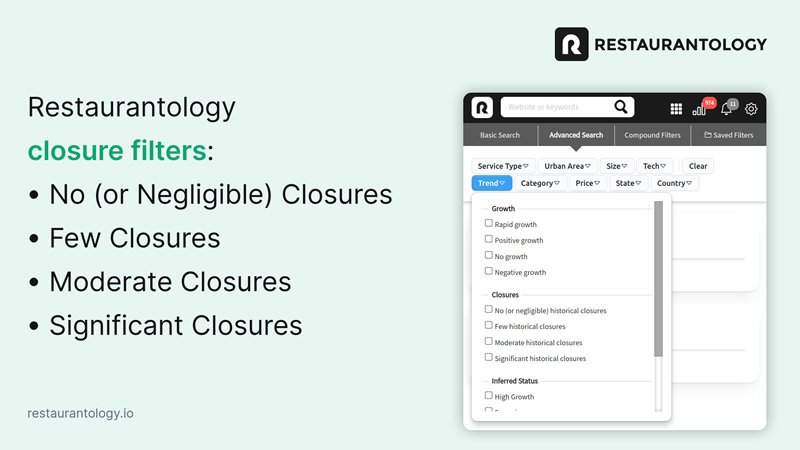

The Restaurantology Chrome extension gives sales and marketing teams an easy way to filter for restaurants experiencing Moderate or Significant Closures. These filters sit under the “Advanced Search” tab and work alongside the other firmographic and technographic filters built into our search console.

There are four ways to filter for Closures:

- No (or Negligible) Historical Closures

- Few Historical Closures

- Moderate Historical Closures

- Significant Historical Closures

Let’s quickly dive into Moderate and Significant Historical Closures to understand how best to interpret and activate the data into valuable insights.

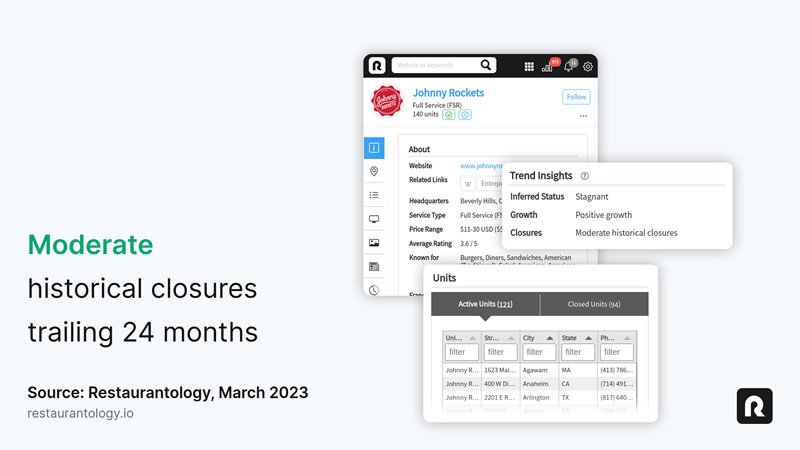

Moderate Historical Closures

Moderate Historical Closures indicate what you’d expect: a list of restaurant brands closing a higher percentage of locations. Flipping the search motion around, you can search for a parent company, concept, or brand for the latest location count and historical closure data.

As an example, looking across 1,255 full-service multi-unit restaurant brands in the 6+ unit space at the time of this posting, 101 concepts (that is, 8%) have had moderate closures in the past 24-month period.

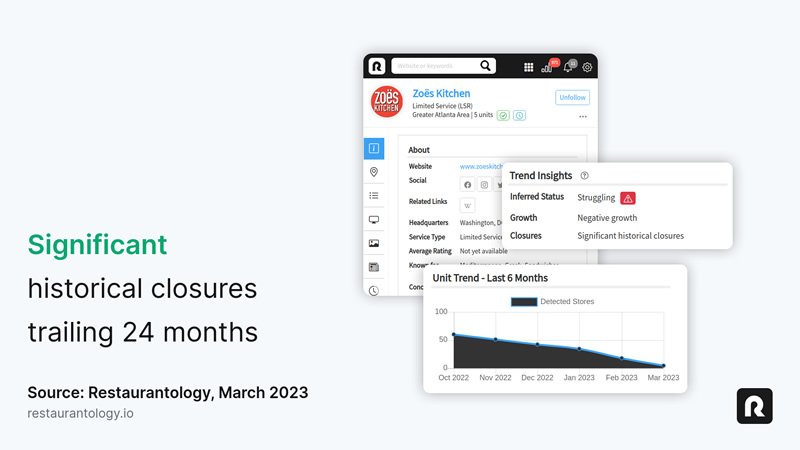

Significant Historical Closures

Significant Historical Closures indicate a more serious, sizable, or rapid pace of store closures. Multi-unit restaurant brands in this category should raise eyebrows among sales and account-based marketing teams and warrant further investigation.

When to exercise caution on historical restaurant closure data

Not all store closures are created equal. In some cases, the data will show a brand having a higher number of historically closed locations than new locations opened. This could be misleading. Digging into the timing and location of the closures and the new location openings can give you a more detailed picture of that brand’s health and growth trajectory.

“Closing out” on restaurant closure market intelligence & insights

In the opening paragraph of this blog, I said that location decline or shrinkage is not a reason to write off a prospect or hit the panic button. And I stand by it. Companies need to grow, improve, recalibrate, or even re-invent their businesses.

Moderate or Significant Historical Closures could indicate a restaurant brand is preparing for or will respond to poor performance with revamps to products, systems, services, operations, technology—you name it.

Combined with additional technographic and firmographic insights, those contraction indicators could point to your next big opportunity.